Bind, Set, Engage

M&A Aftermath: Risk Mitigation or Risk Avoidance?

Earlier this month, I had the pleasure of attending a talk with Guest speaker Joe Meanen, one of the 61 survivors of the Piper Alpha disaster. He spoke passionately about the evening in question and how natural instincts played a huge part in him taking to water. The one overriding message, however, was the cause of the explosion (namely a condensate leak from the poorly sealed disk that had been temporarily employed in place of the safety valve removed for maintenance) had been ignored despite previously been identified during Organisational Due Diligence and Risk Assessment activities.

Several factors contributed to the Piper Alpha tragedy that fateful night, including inadequate safety measures, lack of proper procedures, and failures in communication and emergency response. During the Public enquiry, some of these key aspects were identified:

- Retain and upskill Key Personnel - Workers were not adequately trained in emergency procedures, and there was a lack of awareness regarding the potential risks associated with various operations. Staff attrition and knowledge retention were cited as contributing factors in the lack of coordinated Managerial response (as and when the alarm was raised).

- Communication and Coordination - There were communication breakdowns between the platform's control room and the operations on the platform. Ineffective communication hindered the ability to assess the situation accurately and respond promptly.

- Maintenance and Inspection - Inadequate maintenance and inspection practices were identified. The platform had a history of maintenance issues, and critical components were not properly inspected and maintained.

- Develop an (Emergency) Response Plan - The emergency response procedures were found to be insufficient. The lack of clear guidelines for responding to a major incident, combined with the failure to effectively shut down the platform, exacerbated the consequences of the disaster.

- Regulatory Oversight - Regulatory oversight was also scrutinized in the aftermath of the disaster. There were concerns about the effectiveness of regulations and enforcement in ensuring the safety of offshore installations.

In recent days, I have been pondering whether any lessons could be taken from the fateful event back in 1988, in relation to handling (or dare I say, ignoring) M&A Transactional Risk...

Whilst M&A can be transformative for businesses, offering opportunities for growth, increased market share, and enhanced competitiveness, the road to successful integration is fraught with challenges, and effective risk management is crucial to ensure the realisation of Business Benefit and an effective ongoing operation.

The foundation of successful risk management in M&A lies in thorough Due Diligence. Prior to the integration process, both parties must engage in a comprehensive examination of each other's financials, operations, and potential risks. This diligence extends beyond the balance sheets to include cultural fit, employee satisfaction, and regulatory compliance. Identifying potential pitfalls early in the process allows for informed decision-making and risk mitigation strategies. For the avoidance of doubt, burying heads in the sand just hoping that the risk will miraculously dissolve into the long grass, is not an effective strategy. After all, it was exactly this Leadership hubris that contributed to the biggest disaster in British Oil and Gas history!

Another often underestimated aspect of M&A is the integration of corporate cultures. Cultural misalignment can lead to employee disengagement, productivity declines, and increased turnover. Companies should invest time and resources in understanding and harmonizing their cultures. Establishing a common vision, values, and communication channels helps foster a positive work environment, reducing the risk of disruptions during integration, as explained here:

- Retain and upskill Key Personnel - Employee retention is a significant risk during M&A integration. Key personnel are often integral to a company's success, and their departure can jeopardize the value of the deal. Implementing retention strategies, such as competitive compensation packages, clear career paths, and recognition programs, can help mitigate the risk of losing crucial talent during the transition.

- Communication and Coordination - Effective communication is pivotal in managing risk during M&A integration. Ambiguity breeds uncertainty and resistance, which can hinder the integration process. Establishing clear and transparent communication channels helps keep employees, stakeholders, and customers informed about the progress and potential changes. Open dialogue can also address concerns and build trust, reducing the risk of misinformation and resistance.

- Maintenance and Inspection - Financial stability is perhaps the greatest key indicator of a successful integration. Regularly monitoring and assessing financial performance against pre-defined metrics allows organizations to identify potential issues early. Adjustments can be made to the integration plan or strategies to address financial challenges and ensure the long-term success of the combined entity.

- Develop an (Integration) Response Plan - A well-defined integration plan is essential for managing risks effectively. This plan should include timelines, milestones, and specific objectives to guide the integration process. Identifying potential roadblocks and having contingency plans in place allows for swift responses to unexpected challenges. A cross-functional integration team with representatives from both organizations can help ensure all aspects of the integration are considered.

- Regulatory Oversight - Navigating regulatory landscapes is a critical aspect of M&A integration, as non-compliance can lead to legal consequences and financial setbacks. Conducting a thorough review of regulatory requirements and ensuring compliance at every level of the organization is crucial. Legal experts should be involved throughout the process to identify potential risks and develop strategies for mitigating them.

M&A integration is a complex process with inherent risks, but a strategic and proactive approach to risk management can significantly enhance the likelihood of favourable outcomes. Thorough due diligence, effective communication, cultural integration, and ongoing monitoring of key performance indicators are vital components of a comprehensive risk management strategy. By addressing potential challenges head-on and adapting strategies as needed, organizations can navigate the complexities of M&A integration and emerge stronger, more competitive, and better positioned for future success. Burying heads, hoping that risks just dissolve away is, as was the case of Piper Alpha, a recipe for disaster... Thanks to Joe - his story will never be forgotten.

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via LinkedIn

____________

M&A Aftermath: Business Systems Reengineering

Back in 1999, I wrote an academic paper that focused on whether organisations should ‘repair or replace’ software in response to the threat of Y2K. Today, the question facing decision makers is just as relevant in the context of M&A.

The COVID-19 pandemic has forced many businesses to evaluate and accelerate transformation activities in ways not seen before. Beyond the surge in e-commerce and the use of more online applications, digitalisation has become a priority for businesses seeking to achieve operational efficiency. However, such digitalisation efforts taking place in pockets of a company are unlikely to address the larger imperative of achieving sustainable growth and profitability. Where the business needs to transform to work better, a coherent and cohesive digital strategy is needed. In other words, digital transformation is the means to business transformation.

As companies seek to level up their digital capabilities, leveraging Mergers and Acquisitions (M&As) to acquire technology and talent for digital transformation is a viable approach. Acquisition has advantages in providing the speed and flexibility to capture emerging opportunities before the competition. However, there is also the risk of failure in post-merger integration. Additionally, for those acquiring start-ups, it is difficult to estimate the value of the start-up’s technology to arrive at the right price. Mergers are perhaps the better route to enabling predictable and desirable outcomes especially when the entities involved are complimentary.

Establishing clear governance and leadership is essential for successful digital transformation. Many companies fail to take a strategic and focused approach, with numerous disparate groups within the company undertaking digitalisation efforts in silos. While transformation needs to be a strategic enterprise-wide approach, it can be extremely challenging to successfully execute a comprehensive and large-scale transformation across the entire company. Companies may therefore need to break the transformation project into smaller workstreams, and prioritise the ones to focus on, without losing sight of the strategic vision. In identifying these priorities, companies will need to balance investing for growth and bringing down costs and driving profitability.

Some companies may choose to build and scale their own technology platforms, while others may prefer to reap synergies from strategic partnerships and be part of a digital ecosystem. More than ever, companies should consider if ecosystem participation has a place in their business strategy, given the convergence of industries and the borderless nature of markets where organisations no longer operate in a closed environment and disruptive opportunities exist across the value chain. Apart from accessing new opportunities to deliver products or services, being part of an ecosystem also allows companies to stick to the knitting, allowing the platform provider the cost and burden to keep the ecosystem relevant and feature led.

Being part of an ecosystem does have some drawbacks, with difficulties in identifying the right ecosystem partner, balancing valuable insights with customer data privacy, overlaps in operations, and determining who owns the end-user relationship, commonly cited reasons for failed implementation.

Companies should ask themselves (cost vs benefit analysis) if they want to maintain their own instance of software or whether joining an existing ecosystem allows for productive working.

As you review your position, there a number of things you should consider:

- Do you have a holistic digital strategy that carefully considers 'buying' versus 'building bespoke' capabilities?

- What is your capital strategy to invest in digital and platform initiatives for the mid term (i.e. the next 2-3 years)?

- How comfortable are your Leadership team in running the business through a series of ecosystems/shared platforms?

- How are you reviewing your operating model and integrating acquired digital assets to maximise value creation?

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via LinkedIn

____________

M&A Precursor: Time to sell up?

There comes a time when Start-ups have to consider what’s next in terms of growth (or in the case of Founder led businesses, the acknowledgment that the Business can no longer be taken to the next level under their stewardship). For every small business CEO that is considering their Company’s future, there are many suitors who would be more than willing to open up dialogue about a potential Acquisition. If you are waiting until the economy stabilizes, you are missing an opportunity…

As you consider your position, there are seven things you should contemplate:

- Is your house in order?

Do a self-audit or at least look in the mirror before starting down the road of a transaction. Do you have the right players, in the right seats, and is everything running smoothly (and more importantly, are you Lean)? Understand where you will be stretched during a transaction and where you will pull from to meet the needs of the Buyer.

- Understand your risk tolerance. Identify the risk you can tolerate if things don’t go according to plan with either your organic business or the slowing economy. Do you have your reserves and contingency plans? Thorough due diligence should be expected; small and mid-sized acquisitions by larger companies often mean more detailed due diligence because of the catastrophic impact a failed deal could have on their business. Involve your team members in the diligence as practicable; besides becoming invested in the success of the transaction and post-integration, they become better leaders as a result.

- What’s the growth opportunity? Specifically, what’s the strategic growth opportunity? M&A can drive growth, especially during slower economic times when organic growth may be lagging.

- What’s the Acquirer’s culture like?

Culture is often neglected, especially in smaller deals, even though people and culture are a significant part of how the business became successful. Culture diligence is as important as financial and operational diligence. A culture clash can kill a deal or cause a post-deal integration failure.

- Are you being bold enough? Through exponential growth, a small business can help an Acquirer disrupt an industry and become the industry leader. In short, don’t miss an opportunity by waiting for a stable economy; a good deal in tough times is a good deal.

- Consider your future. Have a frank and open discussion about what a potential Acquisition could mean for you and your leadership team. More often than not, Founders tend to be entrepreneurial in nature, and therefore take time to reflect on the longer term role being proposed by the Acquirer. Will this new role satisfy your burning ambitions or will having to report into a larger ParentCo be too restrictive? Also, keep your eyes open to the possibility that the Acquirer is trying to entice you to stay during the period of negotiation and when the transaction is complete, there may well be other factors that will require you to ‘tow the Corporate line’.

- Are the deal terms favourable? The deal structure will have a major bearing on how long you will need to 'remain invested'. If the purchase is to be an outright cash deal with full transfer of funds at time of Closing, then your reason to stay involved may just be one of personal pride. If the deal is an Earn-Out or involves the Exchange of Share Equity, then you have more reason to ensure that the Integration is successful.

Finally, if you are struggling to contemplate these on your own, seek some help...

Smart business owners know they should work with mentors and coaches to help them navigate the sale of their business. You are heading into unfamiliar territory. It only makes sense to have someone who’s been there to help you navigate the process and help you take advantage of the opportunities in your industry and business model.

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via LinkedIn

____________

M&A Aftermath: Plan fast, Act fast?

While there may be many reasons for pursuing a merger or acquisition, it’s ultimately about creating long-term value for shareholders. That’s what doing business— and deals —is all about. Yet far too often real shareholder value is lost, not gained, after the paperwork has been signed and all the bankers and lawyers have gone home. Achieving financial and operational objectives post close continues to remain elusive. So why are deals continuing to under perform— even when management sets the right course with a solid strategy?

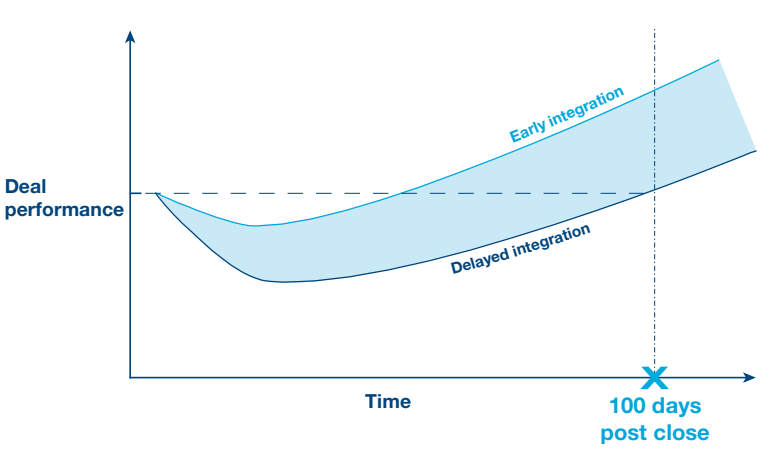

According to a report commissioned by PWC (2018), the early and timely execution of a few key— but fundamental— integration initiatives are directly related to capturing deal value. The time frame in which it is possible to make significant, positive changes is very short. The period from deal announcement through the first 100 days after closing the deal is particularly significant, because it is then that people are most open to new ways of thinking and working. It is essential to set the right course early during the transition, otherwise, attitudes may harden like concrete that sets before it has been poured.

Evidence suggests that more than 70% of integrations fail to deliver the expected results mainly due to the absence of a clear post-merger planning at deal signature. Given that the first 100 days of a merger have a disproportionately high impact on the overall success of an integration, the goal of the first 100 days is to ensure business continuity, reaffirm synergy targets and define the target operating model, while following a critical path to best mitigate integration risks.

Fast integration does, however, come with its own challenges (Joon-Hee Oh and Johnston, 2020). The study concludes that a slower integration minimises conflicts between merger partners, enhances trust-building and reduces the disruption of existing resources and processes in both firms, which may benefit M&As. By contrast, a fast integration that shortens the overall integration process may discourage the combined entity from recognizing the intended synergy quickly.

Conversely, Business Consultants often make mention to the value of a good initial idea, with even more emphasis being placed on a failure to plan effectively or sufficiently, or to implement changes quickly (Bower, 2001). Separate studies (Habeck, 1999, and Booz-Allen, Hamilton, Harbison et al. 1999), focus more narrowly on the synergies or cost savings that the merging firm hopes to gain from the merger. These studies often emphasise failure to identify synergies early-on in the process and move ahead quickly to achieve these synergies and to integrate assets. Other factors include the importance of maintaining premerger revenue growth rates, the importance of clearly delimiting responsibility for merger implementation, and the need to communicate to all the parties involved in the transition.

It is for this reason that SteerCo (the Executive function that provides the Integration Project Manager with direction as to the pace and agenda to follow) plays a crucial role in setting out the Strategic Objectives and reinforcing the Rationale for acquiring. The SteerCo mechanism needs to be the conduit for change and one that allows Integration conflict(s) to be addressed and adequately resolved. To this end, the Programme Organisation must be established early in the M&A Lifecycle with the Project Management and accompanying IMO given the mandate to start their planning activities (bringing the target organisation’s resources to the table) to ensure that as and when the deal is closed, both teams are ready to move into execution phase with a plan that everyone buys into.

My experience has shown that organisations and teams that choose to undertake planning activities only AFTER the deal is closed will often fail to effect change in a timely manner and are often blind sided by the discontent they face when trying to (eventually) align the Target and Parent Companies. This really shouldn’t come as a surprise, as any organisation that is left in limbo for any extended period of time will invariably draw their own conclusions as to what needs to be done, with the potential for engaged employees to undertake activities that go against the Corporate wishes.

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via LinkedIn

____________

M&A Aftermath: "Light touch" or "Full blown"?

Technology, financial services, industrials and energy sectors account for the majority of deals this year, which are being led primarily by corporates, private equity and SPACs (Special Purpose Acquisition Companies). There appears to be a lot of pent-up energy from the fundraising [in 2018 and 2019] that didn’t convert into transactions last year. That dry powder is now being deployed (Bates KPMG, 2021).

With a constant stream of targets continuing to being assessed by advisors and dedicated Due Diligence teams, M&A activity shows little sign of letting up in 2022. Speed has become the new mantra in business promising advantage, prosperity and success. It is now the 'de-facto' standard in the domain of Mergers and Acquisitions (M&A) with a rising tide of practitioners and consultants pedalling the virtues of acting rapidly post-deal and the first 100 days, as critical for acquisition success. This symbolic period has become something of an urban myth but along with its underlying concept of speed as advantage, has not received critical treatment (Angwin, 2004).

In the lead up to SPA signature, Management, quite rightly, start to focus on Day One and the process of integration. A question that commonly features in discussion is, "How deep should we look to integrate [our recent acquisition] into the parent co?" In order to address this adequately, we need to be open and honest in our evaluation of the motives for the acquisition. According to

Christensen et al. (2011) there are two main motives as to why firms engage in M&As. If the strategic aim of the M&As is to boost the buying companies’ performance, deep and fast integration would be beneficial, while if the aim is reinventing the business model, deep and fast integration would be detrimental.

The question of how deep an integration should be performed, therefore, is perhaps best answered by evaluating M&A transaction rationale:

- If the motive of the transaction is to

increase the existing market share or the production capacity, firms are usually seeking for synergy of total addition. In those cases, the value chains are nearly identical and a deep integration is necessary to eliminate redundant resources and to use the increased market share. Thus, integration and integration management, as well as speed, are decisive for the in terms of Benefits realisation.

- If the motive of the transaction is the reduction of cyclicality (common with a diversification strategy), and a firm acquires a company outside their industry, a complete integration is not necessary as value creation does not derive from cost savings or the elimination of redundant resources. In those cases, the integration of financial, controlling, or managerial information systems is often deemed to be sufficient.

With that all said and done, my personal experience over the past 20 years has been that firms acquiring assets base their Integration strategy on how effective the Target has been performing to date. If the business being acquired has been profitable in the recent past, then the Executive choice is more than likely to err on the side of caution. In other words, 'if it ain't broke, don't fix it'. The hope is that the acquired business will continue to perform and that incidental synergies would be realised in the short to medium term, which in turn will keep investors and stakeholders on side. In this scenario, firms choose to undertake a minimal level of integration (focusing purely on Compliance and 'Must-do' initiatives), leaving the business to act in silo. Dare I say, however, it is not uncommon for firms to overstate their attractiveness to suitors during DD (Due Diligence) and when performance starts to lag (or Business Case benefits articulated during DD fail to materialise), it is only then that the lens starts to turn and the hard questions get asked. By which point, it's often too late... Companies are already swimming against the tide and we start to talk about Radical Business Transformation rather than Integration.

It is therefore imperative that Management teams hold frank and honest discussions upfront and early during the DD phase, to better understand and communicate Acquisition Rationale. By engaging and getting buy-in from the target's Management Team, companies will be able to ensure the future direction of NewCorp is well understood. By clearly identifying KPIs and milestones that need to be met throughout the short and medium terms (aligned with the Business Case), teams can help establish the change agenda and that's got to be a 'win-win' situation for all involved!

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via LinkedIn

____________

M&A Aftermath: Onboarding the post-deal Leadership Framework

Leadership capability building is crucial during mergers and acquisitions. Tailoring a pre-close alignment programme for integration leaders can therefore make the world of difference (McKinsey, 2018).

M&A can extensively be viewed as high-profile, high-risk events. Success very much hinges upon executive alignment on the goals for performance and value capture, the approach to mitigating integration risks, and the desired “NewCorp” culture and ways of working. Executives are tasked with making decisions in a pressure-cooker environment of sky-high expectations and tight timelines, shadowed by the knowledge that mergers often define leaders’ careers and legacies, for better or for worse.

Unfortunately, most leaders bring limited integration experience, especially with large or complex mergers. Boosting their exposure to the likely challenges is a critical success factor for pre-close integration planning, a flawless day one, and maximum value capture and integration in the first few years post-close.

Investing in integration leadership readiness is imperative. Leadership capability building has proved to enhance integration results by creating a stronger, more unified leadership team, equipped to take the “NewCorp” to even new heights. Indeed, organizations with the right integration capabilities are two times more likely to exceed cost and revenue synergy targets, respectively, than organizations without the right integration capabilities. Furthermore, executives recognise the need to enhance those capabilities. Asked which dimension of their integration approach requires the most improvement, integration leadership rises into the top three, with 29 percent of executives calling it their biggest concern (Merger Integration Conference, 2015).

Successful integrators have programs for three groups of senior leaders who typically require merger-specific leadership development to execute their integration roles effectively. As these roles involve different responsibilities, the leadership cohorts require tailored capability building.

- The top team (CEO and direct reports) - They must understand and communicate the deal rationale, decide the integration approach and roles, and push the organization to maximize value capture, while protecting the base business from risks, selecting NewCorp leaders, and defining priority cultural integration themes — all the while learning to work together effectively as new colleagues join the team. Furthermore, they need to define NewCorp’s strategy (as well as what NewCorp will no longer do) and convert these aspirations into performance metrics, both financial and operational.

- The integration leaders - They must learn how to manage integration planning to realize the greatest value from the deal and how to quickly mobilise teams that combine people from two different companies and span all functions and business units.

- The broader NewCorp leadership - They must lead integration execution and take the combined company, which is often establishing a fundamentally different culture or operating model, into a new era of higher performance.

The right people for these three cohorts share a distinct profile. They bring strong leadership potential and a collaborative mind-set. They are open to change and recognize the importance of investing in developing their own and others’ leadership capabilities. Should there be any individual(s) within these 3 cohorts not be aligned to the future operating state, then they risk derailing the Integration effort, eroding value and purposefully (or otherwise) unsettling other participants. It is not uncommon for these individual(s) to become disillusioned about the road ahead and in doing so, may start to engineer their exit or simply, through the act of presentism, become a detractor of the Parent Company.

To reduce friction and put the new leadership team on a clear strategic path, I would suggest a series of facilitated, off-site workshops over the six months before the deal’s close, aimed at preventing discontent. These sessions align the top team on performance expectations, governance, and culture, preparing them to execute a seamless close and mobilise their teams to implement the NewCorp strategy. The sessions would be focused on:

- translating the deal rationale into a clear strategic vision for the vertically integrated company

- defining strategic priorities and performance metrics to monitor progress

- establishing the vision, mission and values of NewCorp

- developing the governance bodies and decision rights for the matrixed organization

- setting priorities for cultural change and 'tapping' executive sponsors to lead the change

- building trust among the top team and securing individual commitments to support the new strategy and culture

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via

LinkedIn

____________

M&A Aftermath: If you can’t measure it, you can’t fix it!

It was a cold December morning, many many years ago. I had arrived into the office a little earlier than normal and my Line Manager had just informed me that the firm had been acquired and the new Management Team were in town to rally the troops…

As I sat in the auditorium with my other colleagues awaiting for the Company Presentation to begin, I remember spending a few moments in deep thought pondering whether I had a long-term future in the new organization and whether I would be part of the effort to bring the two companies together. As the clock struck 9am, in walked a young lady who, for the purposes of anonymity, will hereafter be referred to by her initial, M. She took to the stage and introduced herself and in her speech which lasted no more than 5mins, she simply said: “The single thing you need to know is that not only do we see potential in you, your existing customers do as well. My mandate is to get you guys to the next level, but in order to do that we need to start turning these Customers into Fans and to do that, we need to fix this business.” Cue seat shuffling, looks of disbelief among the audience... Hell, we didn’t realise we were even “broken”!

During the next twelve months, M. would continue to visit our UK premises regularly, meeting with myself and with the team, to participate in the Integration Workstreams. She would start each session with the same words: “What Business problem are you actually trying to solve and why is solving this important for our Customers.” During the ensuing debate, she didn’t really say much, she didn’t offer much of an opinion. What she really wanted was from us, was a series of numbers that could be used to qualify our baseline starting position and some targets that would serve to articulate our intent. I eventually got the memo and as time progressed, I learnt that the easiest way to come away from those sessions with sanity intact, was to go in armed with metrics that showed a positive trajectory!

From experience, I can confidently say that Turnaround projects are not only mentally exhausting, they also require a very unique skills set. The individual tasked with performing the transformation has to have tenacity, resilience and above all, an uncompromising eye for detail. They can ill afford to turn a blind eye to any under-performing aspect of the Operation as it is often the series of marginal gains that go towards attaining the bigger prize (MIT Sloan Review [Reeves et al.], April 16th 2019).

A recent study by Basak and Porter (Bloomberg, Dec 28th 2018) highlighted that 1 in 3 organisations have required specialist ‘turnaround’ intervention during the course of their existence, often as a result of a significant deterioration in Total Shareholder Return (TSR). During periods of economic stress underlined by periods of prolonged recession, it is not uncommon to see the proportion of Turnaround based acquisitions increase to well over 60%. And with the current COVID-19 pandemic in full swing, expectations remain that distressed businesses will once again turn to administrators and institutional investors for support in realizing their vision for a better future.

Whilst there is no secret sauce or recipe for executing a ‘Turnaround’, there are however six critical factors which increase the likelihood of success:

- Stick close to the knitting - This was a term first phrased by Peters and Waterman in 1980, used to explain the need for businesses to concentrate on what they are good at and not become distracted by diversifying into totally different activities or enterprises. When a firm is under-performing, it is important to get the show back on the road, stabilise the ship before looking for opportunities to cross-sell or upsell.

- Ring-fence time/money for R&D and Innovation - When you are fighting fires, it is all too easy to focus on the here and now. It is important that you get your organisation to spend some of their time charting out what success looks like in the longer-term. The right level of R&D investment varies significantly between sector, from 6-8% of revenues in fields such as Technology and Healthcare to less than 1% in Energy and Financial Services.

- Agree a long-term orientation - When a company is in distress, it is not uncommon for Accountants and Finance professionals to want to see a recovery before committing to any form of investment, but this is often counter-productive and dare I say, a situation of ‘chicken and egg’. Customers in the SaaS space, for example, will want to have evidence of Product Roadmaps being delivered before they are ready to sign up to longer term contracts.

- Develop a well defined sense of purpose - Rather than focusing only on the financial or competitive benefits the deal is expected to generate, articulate a common purpose that will motivate and help align employees around specific activities and the targeting of a longer-term goal.

- Articulate ambitious synergy targets - Synergies play an important role in M&A value creation in general and that is even more true in today’s climate, with deal multiples nearing historic highs. Buyers need to aim for above average synergies – in terms of both increase revenues and streamlining of costs. Although high aspirations don’t automatically guarantee better results, they do appear to be a precursor for attainment.

- Demonstrate a willingness to act quickly - The single most important factor to achieving Turnaround success is a willingness by the buyer to constantly assess progress being made and take immediate action, as and when required. In a study by Kemgelbach et al., 2018, buyers that launch a turnaround or transformation programme within 12months of deal closure were found to generate 12 percentage points more in 3-year average TSR than those who waited until later.

A winning strategy in Turnaround M&A is one that balances clear and persuasive communication to investors early on (that is, telling them a convincing story about long-term value creation) and then invigorating working teams to deliver on that promise. It requires an unwavering focus on the here and now, a finger on the pulse for the longer-term play and above all, a passion for holding people to account for executing Rapid Continuous Improvement.

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk or connect up via

LinkedIn

____________

M&A Aftermath: Why 'Personal Chemistry' is key to navigating stormy (COVID-19) seas

It is widely acknowledged that integrating Companies (following acquisition) is no easy task. There are cultures to consider, stakeholders to engage and project risks to manage. Whilst a Playbook can be helpful in guiding efforts, a Programme Manager must have the flexibility to acknowledge that every Integration is different and deviate accordingly…

Following the emergence of COVID-19, there have been a number of articles published suggesting a stagnation in M&A activity, with a number of larger companies choosing to hold onto their Cash Reserves in anticipation of having to navigate challenging economic times (compiled Carpenter Wellington PLLC, April 2020). As we fast approach 2021, we are starting to see a number of these Firms ease restrictions aligning with Government advice, with appetite for M&A activity returning to some form of normality (LA Times, 9 August 2020; Software Equity, July 2020).

For M&A professionals, the underlying challenge to rapidly identify, approach and onboard new targets is unchanged, albeit the nature of attack is somewhat different. Whereas in the past, it was commonplace for Bid Teams to jump onto a plane to deliver a presentation to an International Targets’ Board/ Shareholders; or for Project Managers to be onsite to orchestrate and oversee Integration Workstreams, the pandemic has given everyone reason to rethink their modus operandi. For the foreseeable future, travel will be further curtailed, in person meetings will be restricted and the mechanism by which firms ‘keep the show on the road’ will undoubtedly involve increased usage of Zoom/Webex/MS Teams. With such a backdrop, comes the need for Change Managers to sharpen their 'softer skills', demonstrating greater empathy towards individuals, teams and organisations, as I will explain below.

Generally speaking, organisations well versed in M&A activity are aware that there are inevitable ‘ups and downs’ during the course of the process, whether that be in negotiations, due diligence or the post deal Integration. However, the scale of these challenges has been all the more amplified in recent months as a result of not having human, face-to-face contact. According to Deloitte & Touche LLP M&A Advisory, acquiring firms have traditionally looked to engage M&A Dealmakers and Professionals experienced in their specific Technology/ Product domain, knowledge of their industry sector, physical location in relation to the target, international reach and/or Senior Professional attention. However, what the pandemic has shown me is that Firms really need to seek out M&A Professionals who can foremost display Personal Chemistry, in order to stand any chance of executing their ambitions.

I recently attended (albeit virtually) an M&A forum, held by IFR. During the event, I was lucky enough to have conversations with fellow M&A Professionals about the challenges they faced working virtually alongside colleagues, engaging newly acquired teams, and how they have struggled with installing a sense of unity and portraying a brighter future during their virtual interactions. These discussions gave me reason to question whether success in getting things over the line can be attributed to not only hard work, graft, perseverance, but also to the lesser recognised trait of Personal Chemistry. Here are just a few examples as to why I think this skill is vital:

- Outreaching to Potential Buyers / Sellers – the initial contact (whether that be a tailored email, phone call or other contact method) addressing specifics as to why they should be interested in the opportunity from their own Company’s perspective. This is a critical first step in establishing credibility and generating initial interest in the opportunity.

- Negotiations – it helps to establish a rapport with the buyer / seller first and develop a level of trust early on. Previous studies have shown that significant elements of communication are non-verbal, thus the effective use of Video and Conferencing Technology is an absolute must, in order that solid relationships can be fostered. Without these trust foundations in place, deal negotiations will be made far more difficult.

- Due Diligence – assembling / disclosing the mountain of information requests and collating the appropriate responses to any follow up questions, takes not only attention to detail but also requires significant day-to-day handholding (on both the part of the prospective purchaser and the Vendor) and emotional support in order to reach the closure of the process with sanity intact!

- Post Merger / Acquisition Integration – fostering the give and take on numerous deal rationale, working with different agendas and personalities on both sides takes diplomacy, thoughtfulness, and trust to work through the inevitable value creating ‘speed bumps’ along the way and achieve the desired goal for having the sum greater than the value of the individual parts.

While domain experience, industry acumen and knowledge all play a part in achieving successful M&A Integration experiences, the importance of Personal Chemistry should not be downplayed. As COVID-19 continues to restrict travel opportunities, impact business confidence and in particular, affect people’s ability to openly communicate with stakeholders, Change Managers who are able to display an affinity towards 'softer skills', will be best placed to help Organisations achieve value from their transactions and to accelerate their ambitions for growth.

Notes to Editors:

Steve Khetani is an M&A Programme Manager specialising in Post Merger/ Acquisition Integration, Service Delivery and Business Transformation. For more information, please contact

sk@synerg-e.co.uk

or connect up via

LinkedIn